Economic

Vodafone Economic

Economic

Sustainability is at the heart of Vodafone's business model, and over the years, our financial success has gone hand in hand with our long-term ESG commitments and performance. Today, and through our unified purpose and vision, our business and sustainability strategies are even more aligned than ever before, helping us not only to be a successful company that serves all its stakeholders but one that serves the planet as well. Year after year, Vodafone has been at the center of developing inclusive prosperity in Egypt. It continues to expand on those efforts towards improving the high quality of life, growing and bold vision of a future ignited by possibility.

Business Performance

The growing needs of the past years have been paired with unequal opportunities, and thus one of our key ambitions was to ensure that while our business grows and makes profits, this comes along with inclusive offering to all our customers. This way, we have been able to achieve solid financial performance while scaling social and economic benefits. With the growing demand for connectivity and diversification of our services, compared to the previous reporting period, we have grown our revenue by 17% while adding almost 1.1 million new customers. For more information on our selected financial information refer to Vodafone Group Plc Annual Report 2022.

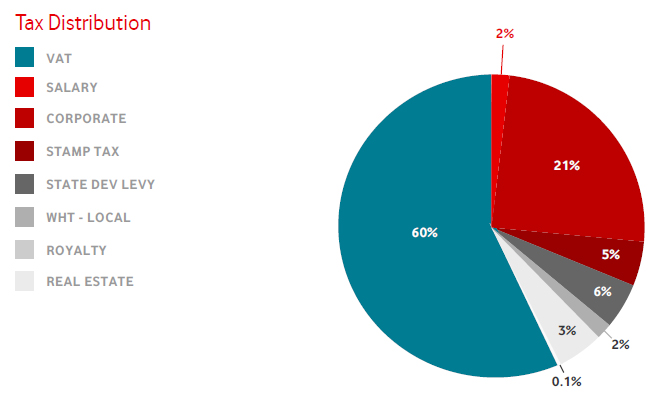

Contributing Our Fair Share

Vodafone Egypt recognises that the taxes we pay is part of our broader responsibility towards the society in which we operate and an essential contribution to its long-term flourishing. And we diligently implement this obligation.

Tax Principles and Strategy

We build upon the Vodafone Group Tax Principles , Tax Risk Management Policy and Tax Strategy to ensure a transparent process on how we pay our taxes.

Tax Strategy Key Components

Tax Value

To manage the tax cost-efficiently to the Group of doing business, including the Group’s cash taxes and effective tax rate, within the ambit of all applicable laws.

Risk and Reputation

To control and manage tax risks and the Group’s reputation through appropriate policies, communication and robust defence.

Business Partnering

To be recognised as a vital business partner by our stakeholders and to facilitate the growth and development of the Group's business activities in a tax-efficient manner.

Customer Experience

To act, where possible, in meeting the above objectives in a way that will enhance our customers' experience.

Influencing

To influence governments and tax authorities constructively and positively in the interests of all our stakeholders.

People

To develop and enhance our people professionally and personally as part of a world-class international tax team.

Compliance

To ensure the integrity of all reported tax numbers and timely compliance with all relevant statutory tax obligations.

Enabling a Vibrant Digital Economy

With a population that is over 100 million people, close to 63 million are eligible to have a bank account, yet only 14 mln of them are banked, and 16.3 mln have mobile wallets. This leaves us with 86% of the population not benefitting from financial services. Our collaboration with other market players and our own services are directed at enabling a truly digital economy in Egypt.

Vodafone Cash

The Egyptian government has been taking various initiatives to encourage digital payments, such as launching platforms to digitize government payments like taxes, customs, personal documents requests. Vodafone Cash (VF Cash) offers an e-wallet that encompasses a variety of services to facilitate daily financial needs and contributes to the national goal to promote financial inclusion and a cashless society. Vodafone Cash aims to give unbanked citizens access to the digital financial world through its services such as remote payments, money transfers, and others. We make people’s life easier by offering fast, safe and convenient ways of sending and receiving money. People can make all their payments and perform a variety of transactions at any time and from anywhere in Egypt with a click.

16.3 MILLION REGISTERED WALLET USERS

81 MILLION TOTAL E-WALLET TRANSACTIONS

65% VODAFONE CASH MARKET SHARE OF TOTAL E-WALLET TRANSACTION

400K+ CHANNELS NATIONWIDE

11 BANK PARTNERSHIPS AND ACCESS TO ATMS

11 ROBUST VODAFONE CASH OFFERINGS AND SERVICES

Services and Benefits

MONEY TRANSFER

DONATIONS

TELECOM PAYMENTS

(Recharge, bundle renewal, etc.

AN ONLINE PAYMENT CARD

Usable on local and international platforms

BILL PAYMENTS

Phone, electricity, water, gas, etc.

PAYROLLl SERVICE

PAY BY MOBILE ONLINE AND OFFLINE

Merchant payment

CARD TO WALLET SERVICE

Depositing in wallet through any bank card

ENTERPRISE AND B2B TRANSACTIONS

Pensions

Under the Central Bank of Egypt regulations, the service operates in partnership with ALEXBANK since 2017, which is also maintained via the MasterCard network. Our partnerships aim to continue to provide innovative financial services with a seamless user experience through a robust, secure platform. Our customers can register at Vodafone Stores only, but they deposit and withdraw money in their wallets at over 250K channels: Vodafone Stores, ATMs in partnership with over leading banks, Fawry & Aman, Bee, Masary, Damen, Sadad and depositing through any credit/debit cards.

Vodafone Cash particularly focuses on women’s financial inclusion and empowerment together with partners such as the National Council for Women on VSLA (Village Saving and Lending Association). We facilitate the creation of women circles, online saving and lending, assist in raising digital awareness, facilitate money transfer and financial inclusion. We were also assigned by the government to digitize the pension experience for elders to replace the time-consuming process of the post office. Beneficiaries now get their money with the least effort and time.

Advancing e-Payments with AMAN

AMAN is one of the rapidly rising players in the e-payment industry in Egypt and one of the biggest IoT customers in different IoT use cases. Vodafone provides Aman with IoT connectivity services, and with Aman digital expansion in solutions and services, it required expansion Applications and APIs whitelisting. Upgrading Vodafone capabilities in line with the latest technologies empowered Aman to successfully expand their digital services and solutions, making workflows more convenient and further expanding access to the e-payments in Egypt.

V-HUB

V-HUB helps organizations succeed in a digital world using our expertise in connectivity and IoT. The rich portfolio of cloud and hosting services is designed to digitize businesses and give them a more flexible, scalable and cost-efficient IT infrastructure to help them build back better. One of the main pillars that Vodafone Egypt has invested in during the COVID-19 era youth and SMEs reflects its strong belief that these segments are pivotal for economic growth. V-HUB assists SMEs and SOHOs in combating challenges that they face when managing their businesses and offers them technological solutions and support.

Vodafone provides user consultation services from subject matter experts with knowledge about the needs of different companies, especially SMEs and SOHOs. The platform encompasses more than 100 digital solutions for the companies in collaboration with global companies such as Microsoft, VMware and SAP. It also provides access to experienced local partners with vast knowledge of the Egyptian market such as CSG, Corporate Stack, Weelo, AIM Technologies, Edafa, Widebot and others. These solutions are available on Vodafone Cloud in Egypt with a high level of data security.

Begin

As part of our purpose to use our digital capabilities and technical know-how in giving back to the community and developing youth skills, Vodafone Egypt has developed its first digital freelancing platform “Begin” that aims to matchmake talented freelancers with a huge number of SMEs & SOHOs to work on freelancing jobs in various fields. Begin will make it easy for all youth (undergrads, grads and disabilities) and women to get the chance to make money for living through Vodafone Cash as the main payment method using their skills and capabilities in the digital field to serve our SMEs and SOHOs on the platform. It further aims to enhance youth and women’s digital skills and financial literacy so that they can pave the way for their future success and help them gain experience.

40+ OPEN JOBS

4K FREELANCERS

2K CLIENTS

BEGIN BENEFITS ZERO COMMISSION DIGITAL CONTENT SECURED PAYMENT PROCESS TWO-WAY RATING BUILT-IN CHATTING